This piece is researched and written by a professional which has the interest to discover the true nature of things behind the financial services and digital platforms. Working on the article, the author devoted much time to the investigation of the work of Doxo, the reviews of its customers, the warnings given by utility companies, the views of professional analysts and the consumer protection groups.

The aim of this study is not to trivialize or exaggerate or put in words an emphatic judgment but to bring out a factual, comprehensive, delineated picture of the phrase Doxo warning and why it is of any importance to the common person who is handling his/ her money through the internet. The purpose of the writer is to equip the readers with information so that they can make informed arguments when managing something as vital as their household and personal bills.

Introduction

The contemporary financial realm has experienced a fast evolution over the past few years. When the paper bills used to be sent through the physical envelopes and paid in form of checks or by personal visits, nowadays most people tend to opt the convenience of the online billing and payments. The promise of having the capacity to pay all the bills at any moment and in any place without the need to care about stamps or envelopes and mail delays have changed consumer behavior. Against this background, third-party company such as doxo warning presented itself as a convenient third-party platform that can help streamline the payment of bills.

However, along with convenience there is cautionary doxo warning as well However, gradually, the negative aspects of using this specific medium to pay bills have received a Doxo warning, by consumers, financial advisors and even the services providers themselves. The warning does not say that doxo warning is fake or entirely unsafe, but rather that more and more people complain about delays, misunderstandings and frustrations that their money has not reached the desired provider on time, or have been charged unfairly.

The relevance of such a topic is because paying bills is the non-voluntary financial activity. Failure to make a payment on time may attract late penalty fees as well as shut off of utilities, loss of credit score, or interruption of services that disrupt everyday life. This article discusses the emergence of third-party billing systems, how doxo warning works, why there have been so many Doxo warning warnings, and why there are alternatives to using doxo warning that are safer. It also discusses the psychology of convenience, regulatory attitudes and actual case studies that help bring out the risks.

The Evolution of Online Bill Payment and the Role of Doxo

The last 20 years have seen tremendous transformation in terms of paying of bills. Banks, credit unions, and financial technology companies have all spent ample supply in coming up with safe, swift, and easy to use platforms that enable consumers to transact their payments within just a couple of clicks. Although direct online payment options are offered by most providers nowadays, the majority of customers were first attracted by the third party services which would act as a single point of reference.

The launching of doxo warning was one of the cash waves of financial innovation. The pitch was straightforward: Rather than signing into a variety of portals–your water company, your electric companies, your medical billing sites, your internet service provider–you could sign into one site on doxo warning and manage all of them within a single interface. This idea appealed to those who were tired of keeping up with several passwords, usernames and billing cycles.

Nonetheless, the same model of doxo warning was also the source of its issues. doxo warning is not always a direct partner to the companies that people are making payments to and thus it can often act as an intermediary where in addition to receiving the payment, the platform will also direct that payment to the companies in question. The mechanics of this forwarding process may include electronic transfers, but in that, occasionally may also include slower forms of transmission, including the mailing of physical checks. This consequently meant that most consumers who looked forward to a swift and flawless transaction suffered delays in making their payments.

The Nature of the “Doxo Warning” Phenomenon

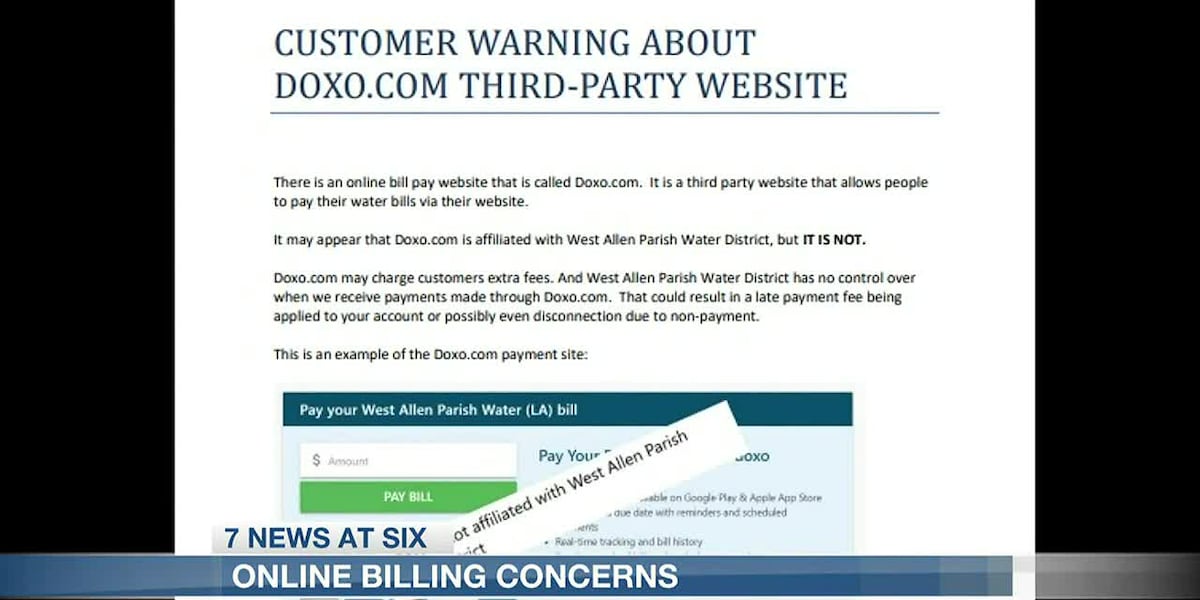

The terms Doxo warning have gained prominence as more institutions and citizens place warnings on the platforms. doxo warning does not always provide guaranteed same-day processing as is the case with traditional banks or provider-owned portals. This distinction might not look so significant, but in the sphere of payments, even a few days of delay may be the reason why an account is paid or assessed by a late fee.

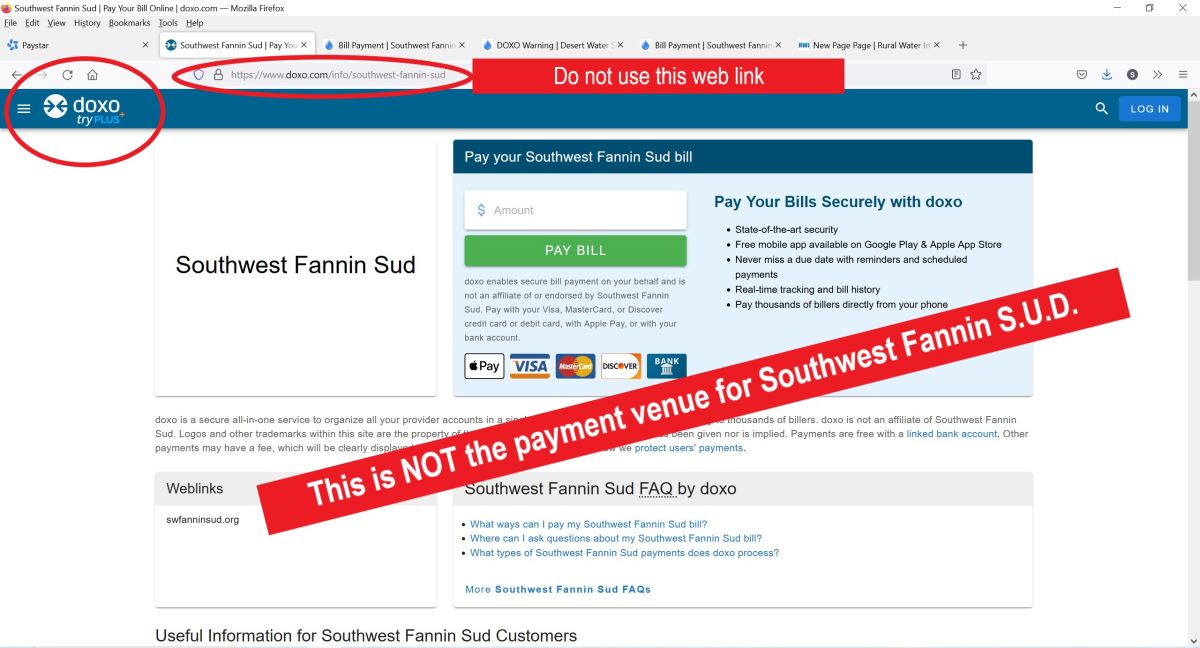

The warnings are normally through a few central themes People also observed that their payments took too long than had been indicated, which led to disconnection of services of the individuals or imposing penalties. Others reports on paying additional fees that they were not aware of the service till they spent almost all of the transaction. What is worrying is that some consumers ended up with the misconception that doxo warning was their utility company payment portal because their logo and company name were depicted on websites or adverts of doxo warning.

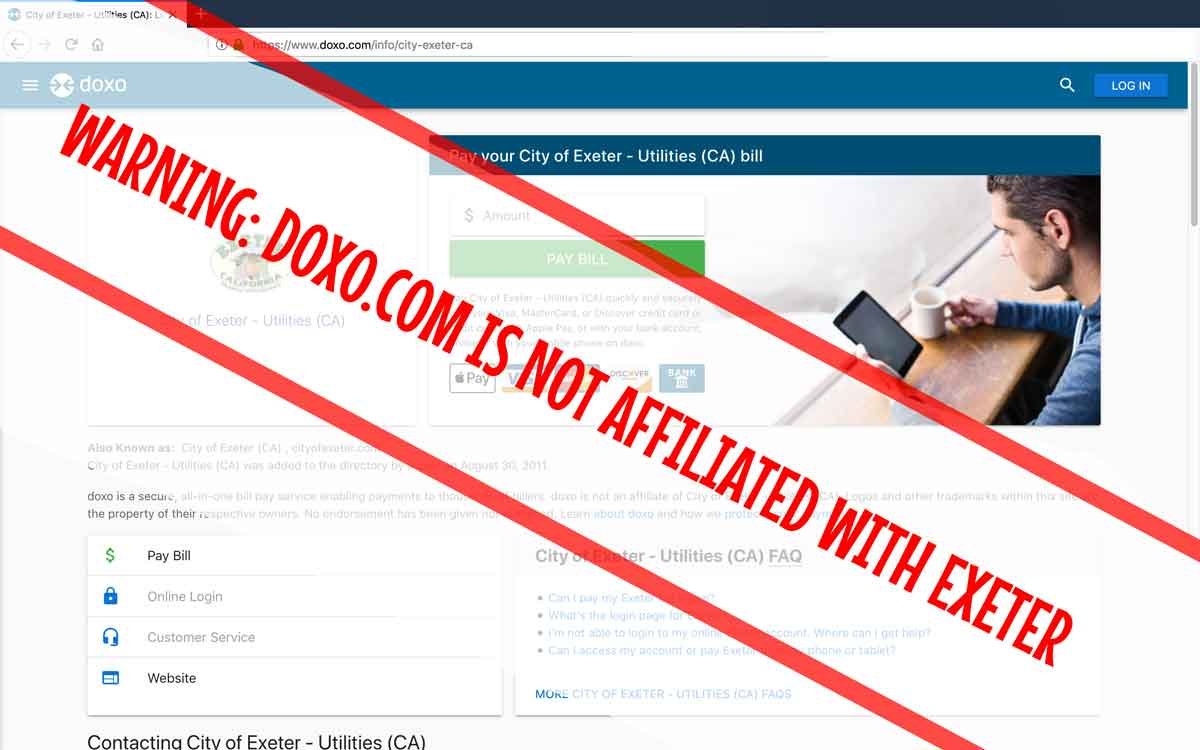

Such misunderstanding has caused many utility providers to issue their own warnings that customers should not use Doxo. These providers also clarify that doxo warning is not the official partner of them. They state that payments processed with the help of the company can be delayed, and that they recommend customers to pay with the help of the official providers channels.

Hidden Fees and Transparency Issues

The most common complaint a company regularly is doxo warning is the nature of its fees. Superficially, doxo warning in many cases advertises itself as free. It is a fact that some of the transactions may be undertaken without extra cost when payment is made through linked bank account. When they come to pay by credit cards or other means however they will often find that there are convenience fees added to each of the transactions which may add 5 dollars or more per transaction.

It has been argued that the manner of placement and disclosure of these fees is not very transparent. Although technically listed when making the payment, not all the customers are aware of this at the onset, which gives them a feeling of being misled. Considering that families or individuals paying the bills are required to pay several bills monthly, they can accumulate on a rather high level and turn what was initially positioned as a free service into an expensive habit.

The Psychological Lure of Convenience

Nevertheless, lots of people still use doxo warning in spite of these problems. To appreciate the reason, the psychology of convenience should be taken into consideration. Time is a precious commodity in a society where time is considered to be more valuable than money hence time-saving services are quite appealing. doxo warning places itself in the position of a service to the person that is busy and is sick of keeping track of an increasing number of accounts, logging into an increasing number of websites and remembering an increasing number of due dates.

The convenience story is a strong one, though. It is usually very deceiving of the dangers behind it. The downside is only discovered by a large number of users when they face a delayed payout or unbudgeted fee. This sluggish perception adds more fuel to the fire of Doxo warnings as the less-than satisfied consumers share negative experiences in order to warn other people.

Case Studies and Real-World Experiences

Think of the example of a family that lives in the Midwest and would pay their electric bill every month through Doxo. It appeared to be going well, months and months, until, one month their payment would take a little longer than usual to carry through. The utility company paid the amount by the time it had already sent a late notice and disconnection warning to the family. The solution involved making phone calls, paying additional money, and enduring a high level of stress.

One more victim, residing in California, stated that she did not realize that she had to add a fee worth 3.99 dollars each time she paid an internet bill since she entered the choice to do it with the help of her credit card via doxo warning.

When she eventually realized, she worked out that she had lost close to fifty dollars in extra charges-money, which she could have spent elsewhere, had she paid via the official portal of the providers, which also offered an ACH payment that was free. These anecdotes explain how the dangers of using doxo warning are not always evident on the surface and that when they do they can result in long-term economic and emotional costs.

The Legal and Regulatory Angle

In the regulation aspect, doxo warning is legal. It is a bona fide company and makes itself known as a third party bill paying processor. Nonetheless, the problems raised by consumers are usually related to the matter of clarity and transparency instead of the prohibition of the illegality. Regulators ensure that companies do not confuse consumers into believing that they are official operators when the individual is not and the consumer should be made aware of any fees that could be incurred in a transparent fashion.

To date, doxo warning has not been hit with any significant regulatory teeth, but the increasing clamor of consumer complaints is starting to attract the attention of busybodies. This state of affairs highlights the fact that much of the responsibility lies on the end users to be aware of the distinction between authentic provider portals and third-party services.

How Consumers Can Protect Themselves

Certainly, alternative solutions to third-party handlers such as doxo warning would be to avoid them altogether, and these safer alternatives do exist. The surest way is to pay them out of the official web-site of the service provider be that a utility company, medical billing portal or a landlord. Majority of the providers will provide free payment choices provided that payment is settled through linked bank account, and payment is reflected in a very short time.

The alternative available is bank bill pay services. A lot of banks and credit unions enable their customers to automate their bill payments by specializing in the online banking. Such payments are obviously quicker and more secure as they are directly associated with the bank and therefore electronically connected with the provider. Auto pay arrangements, so that customers have any bill bills charged against their account each month, are yet another way of ensuring that payments are never forgotten.

How Consumers Can Protect Themselves

No better protection can be aassigned against the dangers here pointed out by the Doxo warning, than vigilance of mind and care in regulating the course of the cup. Consumers are advised to take time to ensure that they are on their official provider Web sites before making payments. It is important that they read carefully any fees that are charged prior to the completion of a transaction and they need to regularly pay attention to their accounts to make sure that they are posting payment timely.

Installation of alerts, reminders, confirmations may prevent any surprise as well. Nothing is a better armor than awareness. Being informed on risks to monitor can also help individuals to defend their funds and stay away from the stress that might occur due to the lack of knowledge.

Frequently asked questions (FAQ)

What does Doxo warning imply?

It is the set of consumer complaints, advisories relative to the utility company and financial experts warning of the use of doxo warning to pay their bills. The word arouses suspicions of late payments, branding confusion, and other costs.

Is Doxo a scam?

Doingso is not a scam in a fraudulent or illegitimate sense. It belongs to the real world where it offers the bill payment services. Nonetheless, its practices have misled many of its users and this has contributed to its bad reputation.

Why is Doxo available from warnings issued by utility companies?

Since doxo warning is not part of them and the payments through them could take time to be effected, some companies prefer to caution their customers against those risks. They rather want the customers to access their official portals

Is Doxo fee based?

Yes, depending on the way of payment. Bank account payments are sometimes free, but credit card payments are charged high amounts of service fee.

How can I pay the bills safety?

The official site or portal of your provider is usually the safest and the fastest and the least expensive method of paying bills.

Conclusion

The Doxo warning is not merely a slogan, but an acknowledgement of the incongruences consumers will continue to encounter in a world that continues to be equal parts convenient and complex. doxo warning is not always fraudulent, and it can work satisfactorily with some clients. Nevertheless, the dangers of delayed payments, obscure fees, and misunderstanding about partnerships should be evaluated as reasons to be wary of the platform.

The consumers are ultimately well served when security and reliability are paramount and not convenience. Nevertheless, there is less risk of delays, extra costs, and customer support inconveniences as bills can be paid through websites used by official providers or bank systems of bill payments. The lesson to be drawn here with the growing use of digital financial services is that not all shortcuts are worth the risk.